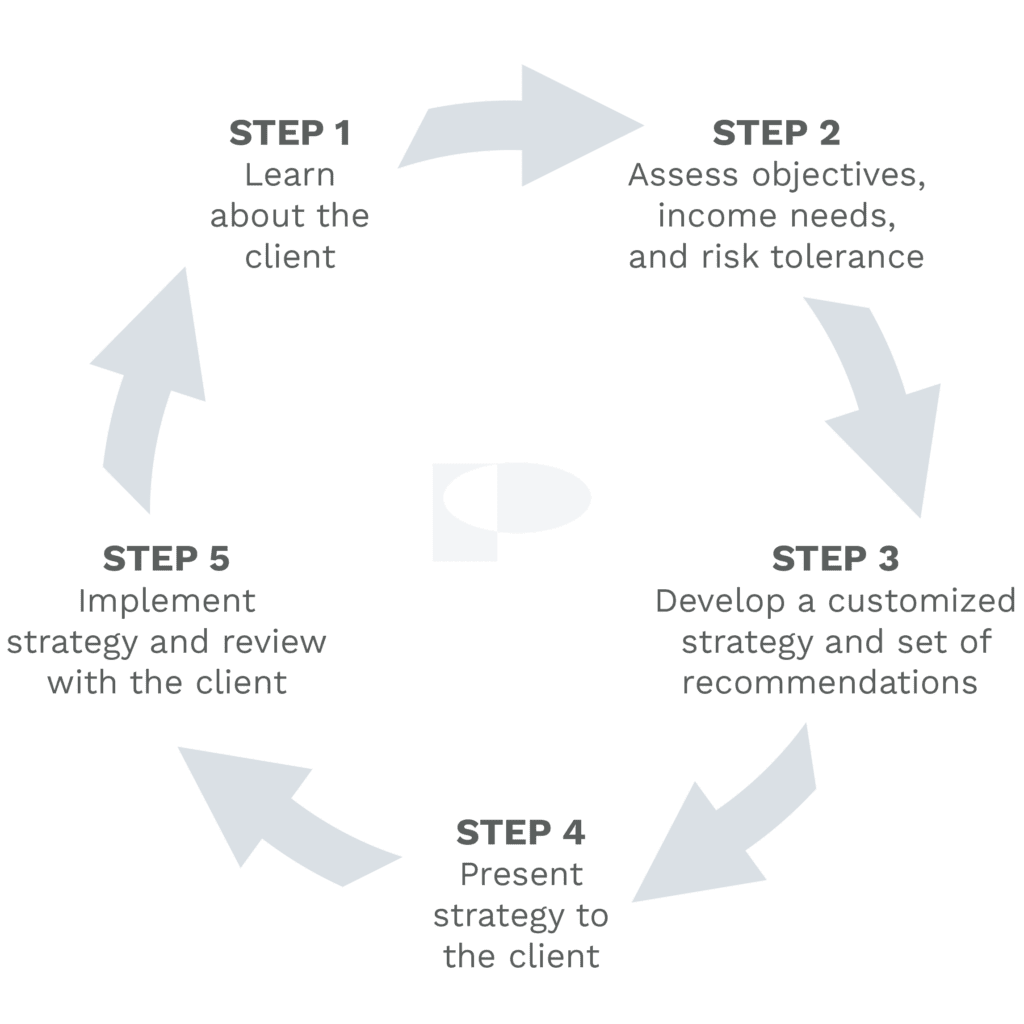

Our process for creating investment strategies is comprehensive, consultative, and dynamic.

One of Patten & Patten’s core beliefs is that investment strategies are most effective when they are customized. We recognize that no two clients are the same. For this reason, we do not use model portfolios or generic strategies intended for broad swathes of clients. Rather, we apply a comprehensive, consultative, and dynamic investment process to design investment strategies tailored to the specific needs of our clients.

At Patten & Patten, clients interact directly with the decision maker for each account – i.e., the portfolio manager. At the beginning of every new client relationship, our portfolio managers invest time to gather information such as investment objectives, cash flow needs, and risk tolerance.

For individuals and families, our portfolio managers then analyze the information and formulate a long-term investment strategy to achieve the client’s specific objectives.

For foundations and endowments, we typically formalize the information in an investment policy statement. We will also manage investments within the bounds of existing investment guidelines and help organizations update policies as needed.

Patten & Patten’s process does not end once portfolios are fully invested. Rather, our investment process is dynamic, allowing for adjustments as client needs evolve and market conditions change. To facilitate this process, we encourage frequent communication with clients and attempt to meet regularly to review investments.

Every client relationship is managed on a separate account basis. This means that client assets are not commingled with others. Instead, each client has their own account that is custodied with one of our third-party custodial partners (e.g. Charles Schwab, Pershing Advisor Solutions). This structure facilitates creation of a customized portfolio that fits the client’s specific needs.